Cook County Homeowners Risk Paying Too Much in Property Taxes When They Don’t Appeal

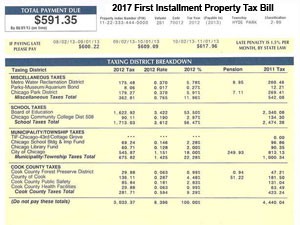

The least favorite piece of mail Cook County homeowners receive hit their mailboxes last month: the dreaded property tax bill.

The least favorite piece of mail Cook County homeowners receive hit their mailboxes last month: the dreaded property tax bill.

It requires payment by March 1 of a sum equal to 55% of last year’s taxes. And it’s only the first tax installment. The second, in July, will reflect last year’s big tax increases and those planned this year for Cook County and Chicago.

“Ironically, these tax bills serve as a reminder that you should always appeal your taxes, but by the time you receive the bill it is often too late to appeal for that year,” said Frank Dal Bello, CEO of Kensington Research and Recovery, the Chicago-based, Cook County property tax appeal and refund recovery consultants.

Over-Assessed & Under-Appealed

Up to 60% of U.S homes are over-assessed, but fewer than 5% of owners file challenges, says the National Taxpayers Union. “When owners do appeal, they often leave money on the table by appealing without the expertise, capabilities and data a professional tax consultant can provide,” Dal Bello said.

“By contrast, taxpayers appealing with the assistance of Kensington often obtain significant reductions, easily and at no expense unless the appeal is successful,” Dal Bello added.

Kensington Strikes Pay Dirt on 90% of Appeals

Kensington has helped reduce property taxes on over 90% of the appeals it has consulted on, benefiting over 10,000 Cook County taxpayers. That compares with a 60% success rate on all appeals, as published by the Cook County Assessor’s office.

As part of its valuation process, Kensington applies its proprietary tax algorithm to analyze thousands of assessed values, sales transactions and appeal results. The firm compares its client’s property with others sold recently and looks for variations in the home’s assessed value versus those of neighbors – i.e. “comparables” or “comps.” Kensington also seeks savings when a property’s value can be determined based on the net income it generates.

Appealing Twice Yearly

“We recommend appealing twice every year, even though re-assessments are three years apart, since the strength of your argument may improve and property taxes almost surely will increase,” said Dal Bello.

Taxpayers can appeal with the Cook County Assessor and Board of Review during month-long filing windows, staggered throughout the year by township. “Our web site shows taxpayers the dates of the 2017 scheduled appeal filing windows by township, starting in late January,” Dal Bello said. “If savings during the Assessor’s window are below our estimate, a second appeal during the Board of Review’s window becomes available within the following six months.”

When Is the Best Time to Appeal?

Did you ever hear the old adage, when is the best time to plant a tree? The best time: 20 years ago. The next best time: now.

Tax reductions granted based on a successful appeal this year will be applied to the second installment of bills sent out in mid-2018. We know that’s a long time to wait but it will be better to see a reduction in 2018 than none at all, and the compounding effect from one successful appeal may save you money in subsequent years.

Homeowners can now receive a free, no-obligation estimate of potential savings and an opinion on whether an appeal makes sense from Kensington Research. Just click on the button below to get started.

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees