COVID-19 Property Tax Relief Adjustments for South and West Suburbs

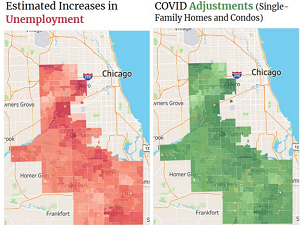

With the release of a report describing how the Cook County Assessor’s Office will factor the COVID-19 pandemic into the assessed property values for the South and West suburbs, Assessor Fritz Kaegi describes how record unemployment and the ongoing economic uncertainty will be factored into values reflected in next year’s property tax bills.

The May 28 report describes the research and methodologies the office is using to create COVID-19 tax adjustments for the South and West suburbs, which are scheduled for reassessment this year under the system by which the office reassesses roughly one-third of the county’s properties each year.

When it became clear that this year would require a different approach, Kaegi’s office began what it describes as a “wide-ranging inquiry” to determine how to incorporate COVID-19 side effects like unemployment and the loss of both residential and commercial rental income into assessment calculations.

The report includes “estimated value adjustments” of between 8% and 12.2% for 942,728 single-family homes and condos and between 10% and 15.2% for 166,159 2-6-unit multi-family apartment buildings.

Unemployment Levels Factored into Assessments

The residential adjustments, one for single-family homes and condominiums and a second for multi-family homes, will be tied to localized unemployment levels created by looking at both census data and industry-specific unemployment, according to the report.

The adjustments apply to the following suburbs:

- Berwyn

- Bloom

- Bremen

- Calumet

- Cicero

- Lemont

- Lyons

- Oak Park

- Orland

- Palos

- Proviso

- Rich

- River Forest

- Riverside

- Stickney

- Thornton

- Worth

A second report is to be issued at a later date describing the adjustments for the North suburbs and Chicago, which were last reassessed in 2019 and 2018 respectively.

Commercial properties will also receive adjustments based on an analysis that includes the shutdown’s effect on specific commercial categories and accounts for things like reduced rent collections, low hotel occupancy rates, and restaurant and entertainment venue closures.

The Difficulty of Getting Assessments Right

Creating fair assessments is a difficult task in the best of times. And no one can predict exactly what the real estate market is facing. As an article in Crain’s Chicago Business noted, “Without good data, estimating what a property is worth becomes a guessing game…The extra workload increases the risk that assessments will be arbitrary and inaccurate…”

As the first global pandemic of the 21st century, there is no formula for predicting the full economic impact of COVID-19. During the housing crisis of 2008, some homeowners paid more in property taxes than in the previous year despite property values falling drastically.

Appeal Property Taxes to Ensure Fairness

While you do not need to file an appeal to receive the benefits of the COVID-19 adjustments, appealing your assessment is the only way to ensure that you are not paying more than your fair share.

An appeal ensures that your property is assessed individually, taking into account the right comparable properties. An across the board adjustment cannot reflect the specific circumstances of your property tax bill.

At Kensington, we have deep expertise in the data and research that creates the strongest possible case for reducing your assessment. Give us a call or click on the link below and we will prepare a free, no-obligation analysis of your tax bill. Take the first step and learn why so many Chicago-area property owners have used our services to help them save millions of dollars in property taxes.

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees