Appeal Deadlines Suspended as Cook Assessor’s Office Manages the COVID-19 Threat

With health and safety as the primary concern at the moment, the Cook County Assessor’s Office has temporarily suspended the deadlines for appealing your property tax assessment and the physical office is temporarily closed to the public.

With health and safety as the primary concern at the moment, the Cook County Assessor’s Office has temporarily suspended the deadlines for appealing your property tax assessment and the physical office is temporarily closed to the public.

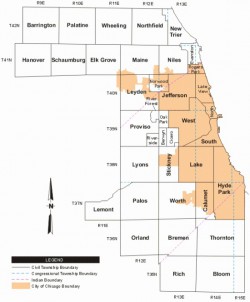

If you live in one of the nine townships where the appeals window was open as of March 19, that means you can still file an appeal online, and the processing of appeals will continue. Residential property owners can also file applications for any of the various exemptions online as well.

If you live in one of the townships where assessment notices have not yet gone out, new dates for your appeal window will be announced as soon as they are available.

Kensington Taxpayer Advocates are Available to Help

In the meantime, at Kensington, our appeals staff is working remotely and available to help you attempt to lower your assessment. We are processing applications using e-signatures so you will not have to leave the safety and comfort of your home to begin the process of reducing your property tax bill. We will email you all of the required documents and you can sign using a smartphone, tablet or personal computer.

Continue reading

2020 Triennial reassessment notices were mailed to Palos Township homeowners on Friday, March 13th. Homeowners in Palos Township have 40 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is May 1st.

2020 Triennial reassessment notices were mailed to Palos Township homeowners on Friday, March 13th. Homeowners in Palos Township have 40 days to appeal their assessment at the Assessor’s office (there will be a second opportunity to appeal later in the year at the Board of Review, whether you appeal at the Assessor’s office or not). The deadline for appealing at the Assessor’s office is May 1st. The Cook County Board of Review has opened 2019 property tax appeals for the second group of 2 townships. The

The Cook County Board of Review has opened 2019 property tax appeals for the second group of 2 townships. The

Over 90% Success Rate on Property Tax Appeals & Protests

Over 90% Success Rate on Property Tax Appeals & Protests No Up-Front Fees

No Up-Front Fees